Hi, what are you looking for?

Stock

In this edition of StockCharts TV‘s The Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving...

Stock

EB Weekly Market Recap VideoIf you haven’t seen our latest weekend recording, it’s now available HERE at YouTube.com.Sample – EB Weekly Market ReportThis is...

Stock

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look “Under the Hood” to...

Stock

Good morning and welcome to this week’s Flight Path. The equity “NoGo” trend struggled this week as prices climbed from lows. We see an...

Stock

We’ve all heard that popular Wall Street adage, “Go away in May”, right? It’s cute and it rhymes, so why wouldn’t we make the...

Stock

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and...

Stock

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews the key drivers for this week’s volatile period, including Core PCE and...

Stock

In this edition of StockCharts TV‘s The Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent...

Stock

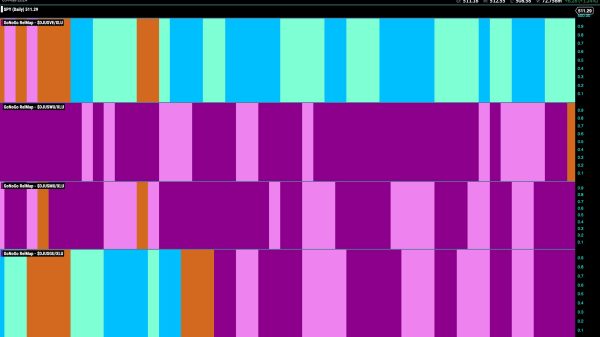

Stocks fell sharply into late April and then rebounded over the last two weeks. SPY fell 5.34% from March 28th to April 19th and...

Stock

The weaker-than-expected jobs report gave the stock market some direction, a nice treat before the 150th Kentucky Derby. Job growth slowed, and the unemployment...