Now that Q4 historical bullishness has kicked in, it’s time to allow the bears to go into hibernation, while the bulls search for key leadership to drive prices higher. Before I highlight a key industry group that just moved into all-time high territory, it’s important to understand the history of the stock market and which groups tend to carry the S&P 500 higher. In other words, since the S&P 500’s 2013 breakout above the 2000 and 2007 highs, which groups have led this secular bull market advance? Well, here you go. These are the 12 best-performing industry groups since April 2013 (as you check these out, keep in mind that the S&P 500 has gained 266% over the same period):

Semiconductors ($DJUSSC): +1488%Computer Hardware ($DJUSCR): +1019%Software ($DJUSSW): +774%Specialty Finance ($DJUSSP): +709%Internet ($DJUSNS): +683%Broadliine Retailers ($DJUSRB): +653%Automobiles ($DJUSAU): +480%Home Construction ($DJUSHB): +459%Insurance Brokers ($DJUSIB): +434%Home Improvement ($DJUSHI): +424%Hotels ($DJUSLG): +419%Consumer Finance ($DJUSSF): +416%This isn’t opinion. This isn’t a list based on current technical conditions or my favorite groups. This list is HISTORICAL FACT. These are the “risk on” groups that have led this bull market. If you’re still clinging to the hopes of a secular, or even cyclical, bear market right now, I think you need to leave personal biases at the door and look at this market objectively. All-time highs nearly always beget more all-time highs. In my lifetime, I’ve only seen TWO all-time highs that marked major tops – one in 1973 and the other in year 2000. Constantly searching for that major top is what leads to significant underperformance. Personally, I believe the next major top (leading to a secular bear market) is most likely a decade away. We’ll all find out together.

So I’m in a position believing that stock prices are going to go higher. I’m also of the belief that many of the same leaders shown above in the Top 12 groups since 2013 are going to lead the next leg higher in this secular bull market. Therefore, I’m paying particularly close attention to these charts……and one of them just broke out and started to lead on a relative basis during the past week.

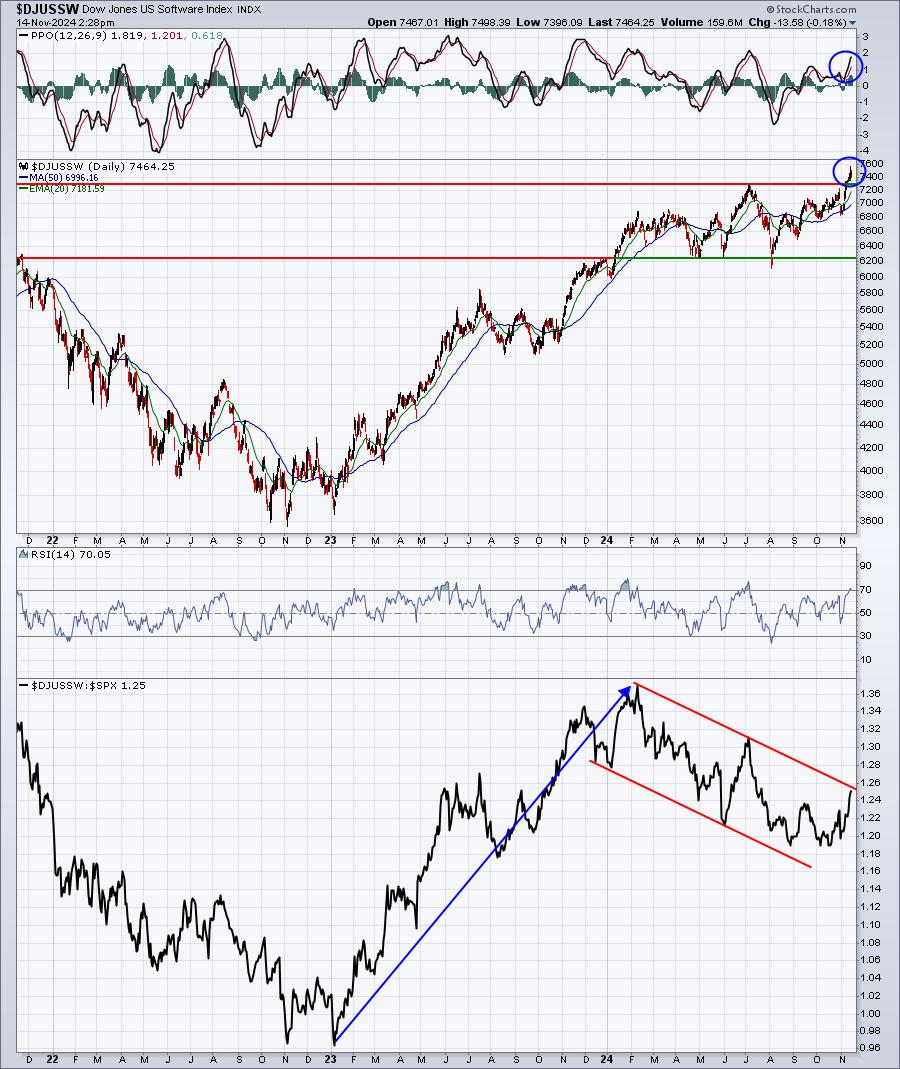

Enter Software:

The absolute price breakout has already occurred. Now I’m waiting to see the relative breakout on the DJUSSW. Once that happens, I see a melt up in software stocks, especially among small and mid cap software stocks. It’s important to point out that in this environment of falling short-term fed funds rates, small and mid caps are showing tremendous leadership. As I look ahead, I believe small and mid caps will TROUNCE the S&P 500. All of this will lead to many small/mid cap software stocks tripling or quadrupling within a year. I’m going to uncover them.

On Saturday morning at 11am ET, I will be hosting a webinar, “Capitalizing On Small- and Mid-Cap Strength”. The objective of this event is to illustrate the strength in these two asset classes and to discuss potential levels of outperformance and to point out many stocks poised to lead. If you want to find stocks capable of tripling, quadrupling, or even more, then this webinar is for YOU! The webinar is completely FREE (no credit card required), but you must register for the event to save your seat – and seats are limited. For more information and to register NOW, CLICK HERE.

Happy trading!

Tom